Stock markets across the globe had a blood bath in the past three weeks with key indices tanking somewhere between 3% to 5% owing to fears of an escalated US China trade war. Trump administration’s withdrawal from 144-year-old Universal Postal Union, the treaty which helps to set universal postal rates, fuelled this fear. This step aimed at China is America’s latest move in the escalating trade war between the world’s two largest economies.

US government has so far slapped tariffs on 40% of goods that it imports from China. Most of these goods include consumer goods like furniture, apparels, electronics etc. While this may seem like a minor move, when we take the numbers into account the magnanimity of these sanctions become clear. China is the single largest exporter to the US, with exports amounting to over USD 500 billion in 2017(1). On the other hand, US exports to Beijing are a fraction of what it imports from China, leading to a trade deficit amounting to a whopping USD 375 billion (2). US government aims at closing the deficit gap with China by making the Chinese goods costly, thus leading to a decrease in Chinese imports. These moves have put Chinese economy is a lurch as exports are facing a decline. On the other hand, they cannot retaliate to the extent of US as their imports from America are far less compared to their exports.

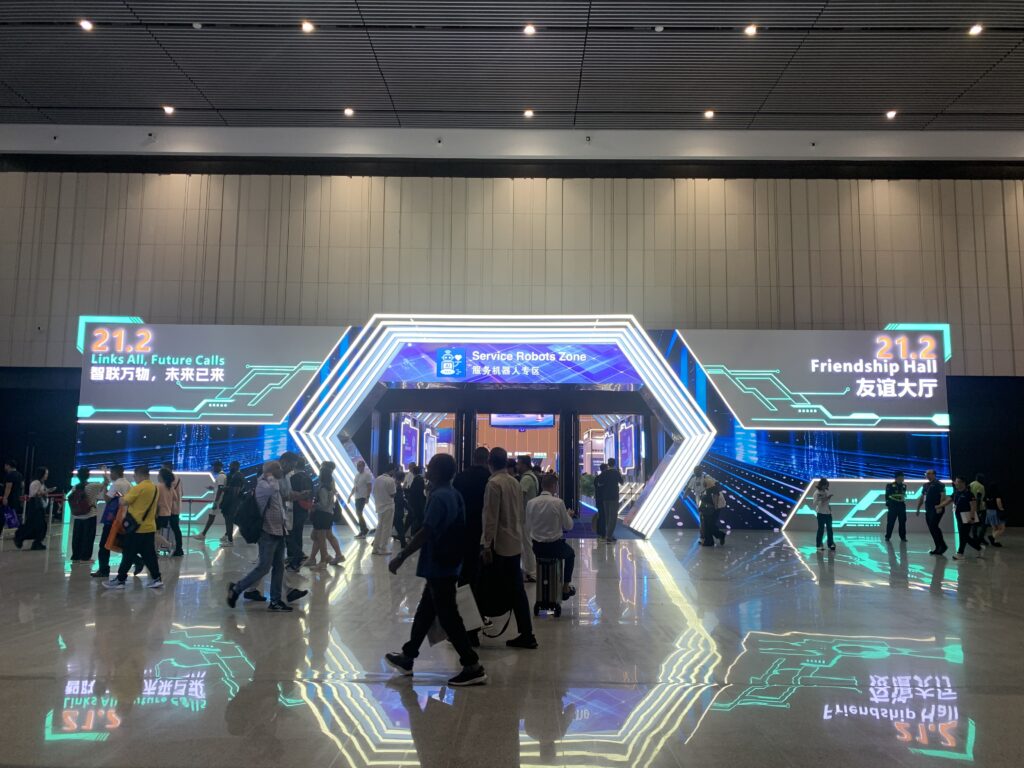

While the Chinese economy is showing signs of slowdown in the near future, the world largest manufacturing economy has already stared scouting new markets for its products. China has started wooing the European markets by signing trade agreements and giving them better access to their economic and financial systems. Like US, China is also Europe’s single largest importer but unlike US, Europe is not imposing any major tariffs on Chinese goods. This has translated into Europe becoming a favoured partner for China.

China is predominantly a manufacturing economy, and one advantage of being a manufacturing economy with cost advantage is that you will easily find market for your products. China is doing the same thing by scouting new markets and forging trade agreements. It may have to sale its goods at a cheaper rate to attract new customers but it will find its feet provided the situation at home remains stable

Washington’s protectionist policies are leading to a paradigm shift in global trade. With US imposing tariffs on China, Canada and the European Union, trade ties amongst these economies are increasing. This is leading to a change in global trade scenario with US losing its favoured country label for the first time since World War II. An economist from Forbes magazine has gone on to say that this is bringing power back to Asia and US itself is challenging its global dominance by acting obtuse and arrogant with the rest of the world (3).

Post US tariffs and sanctions, the global economy will thrive but US may not be at the receiving end of the benefits of this growing economy.

Sources:

Trade in Goods with China. (2017). Retrieved from www.census.gov: https://www.census.gov/foreign-trade/balance/c5700.html

AMADEO, K. (2018, October 20). US Trade Deficit With China and Why It’s So High. Retrieved from www.thebalance.com: https://www.thebalance.com/u-s-china-trade-deficit-causes-effects-and-solutions-3306277

Hedrick-Wong, Y. (2018, September 11). The U.S.-China Trade War And Global Economic Dominance. Retrieved October 22, 2018, from www.forbes.com: https://www.forbes.com/sites/yuwahedrickwong/2018/09/11/the-u-s-china-trade-war-and-global-economic-dominance/#3cc4f5b9256a